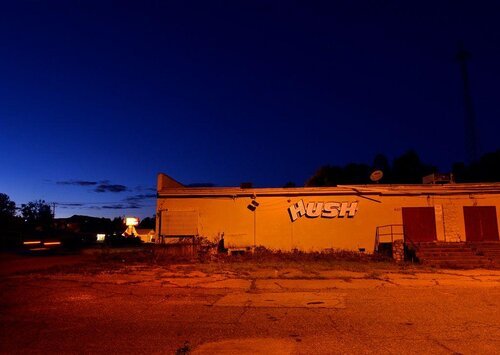

Overlooked Properties

Where some people see eyesores, we see opportunities.

Blackstock Development takes pride in finding the highest and best use asset class for overlooked or underutilized real estate. Our team turns problem sites into successful developments in transitional growth markets.

current redevelopment projects underway

Asset Class Spectrum

Blackstock Development looks to partner with existing, experienced professionals to develop or redevelop property across many different asset classes. To date, Blackstock Development has developed single family subdivisions, apartment communities, senior living communities, self-storage facilities, and mixed-use projects that include various components. All of these projects have certain commonalities between them, and by forming various partnerships with specific asset class professionals we can achieve more viability for the project, our partner, and our company.

Westgate Assisted Living

Restoration complete: Spartanburg, SC